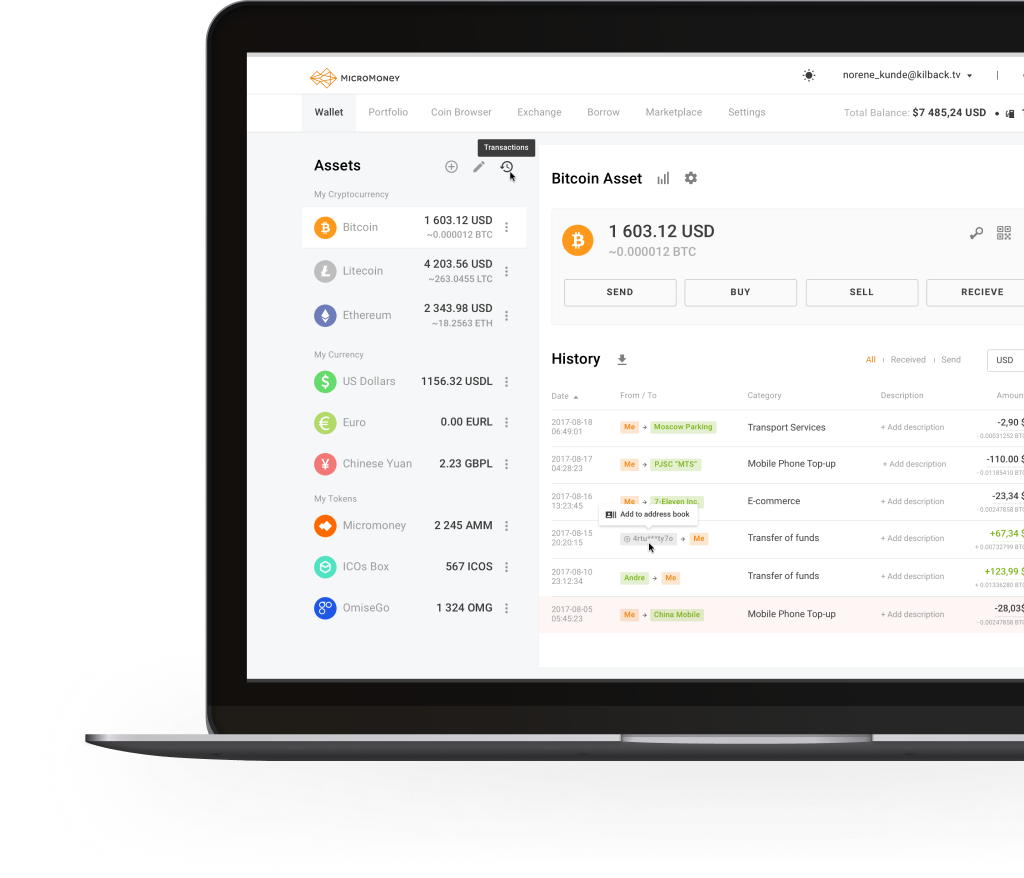

An all-in-one wallet

Buy and hold any coins, tokens or even FIAT, top-up mobile phone, pay utility bills, etc

A protocol for non-collateralized, on-chain

loans for unbanked people on Polkadot

We help unbanked people to get loans

100 out of 196 countries have 2,000,000,000 unbanked people. However, these people still need funds. We connect new customers to all existing financial services.

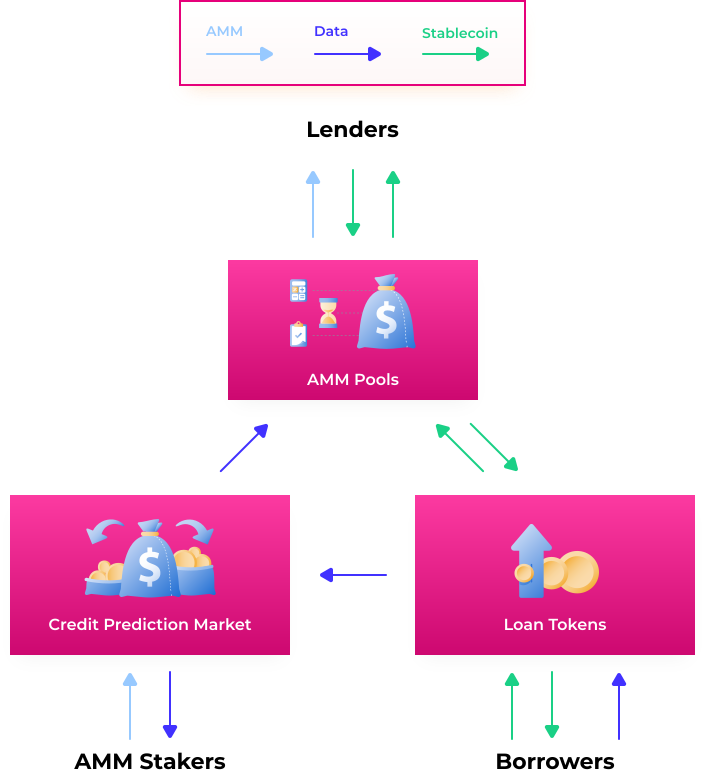

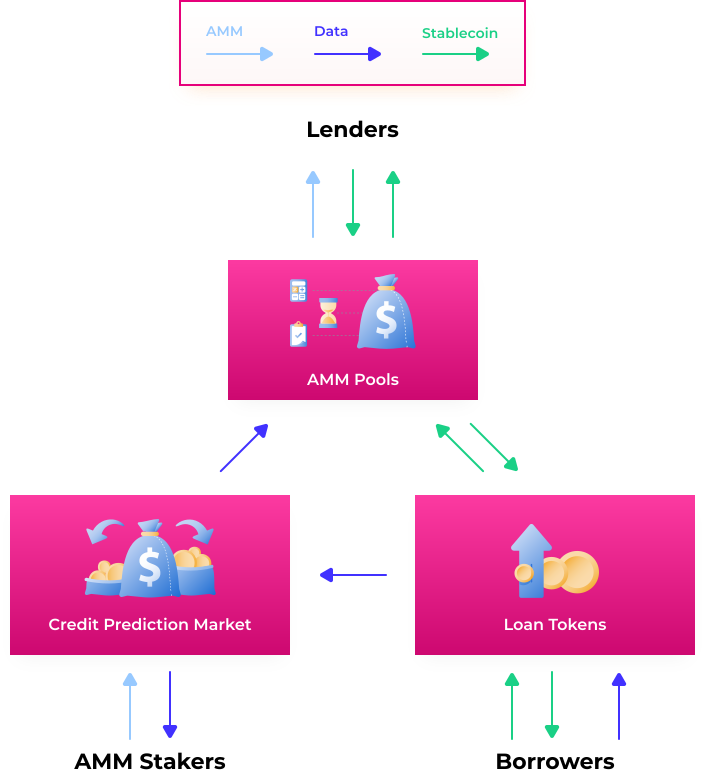

AMM token new approach

A new approach to on-chain lending that allows AMM holders to vote on incoming borrowing and uncollateralized loan requests; it creates new ways for AMM users to generate stable, high returns in DeFi; and it empowers approved borrowers with fast, fixed-term, fixed-rate loans with no collateral requirements. The AMM incorporates Binance's and Polkadot's best advantages!

Fast and smart credits

The platform uses complex algorithms to predict the credit-worthiness of every customer and in just 15 minutes, a borrower can get their very first loan through their smartphone.

Micromoney Advisors

UNSECURED LOANS - INSTANT ACCESS TO LIQUIDITY WITHOUT INITIAL FUNDS

Buy and hold any coins, tokens or even FIAT, top-up mobile phone, pay utility bills, etc

How Unsecured Loans Work

Interest Rates for Borrowers

Why Borrow?

A personal decentralized credit line

Instant money on-demand

A cost-effective process for collateralization

Ability to unlock new assets for funding

Flexible and advance payments

No banks or bureaucracy

Why Lend?

High yields with low risks

Transparent securitization and tracking of each asset

Liquid investments into illiquid assets

Round-the-year returns

Be part of the bankless community

Competitive risk assessment/underwriting

In order to provide the best functionality and smooth working of all features, the MicroMoney system leverages the best from several blockchains. We emphasize Polkadot's blockchain the most as it: has easy cross-chain transfers, has good scalability, is easy to improve, is user-driven and is absolutely secure.

Since Polkadot is a cross-chain protocol, we can aggregate the products of our partners to provide customers with access to services on other blockchains.

Software and blockchain development for businesses

Our technology stack

Places We Previously Worked

Unsecured DeFi Loans

An under-collateralized lending market, available anytime and anywhere!

MicroMoney's Unsecured Loans only require borrowers to maintain the collateral equivalent of the value of the loan minus the amount of total interest paid from all previous loans.

Anyone can take out a loan, even if the initial collateral equals zero - you will receive money if you need it!

Each next loan is 6% larger

Lenders are well-protected against 'take-and-run' actors by the membership system and the redemption pool algorithm.

PRESS

about MicroMoney

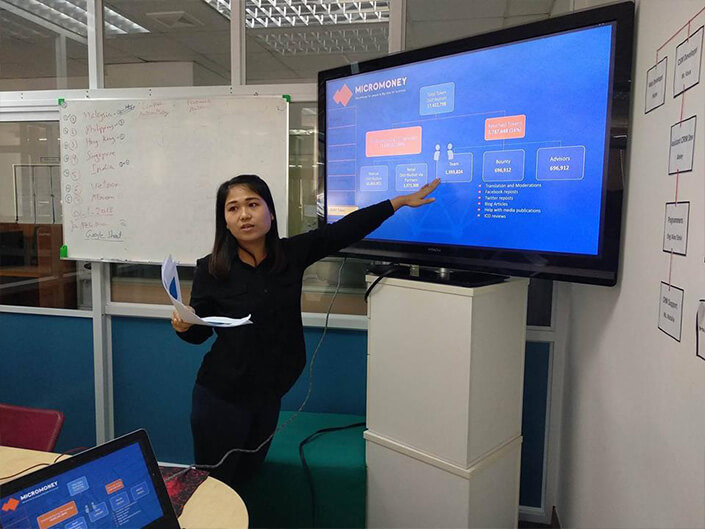

Our local offices

We have branches in Myanmar, Thailand, Indonesia, Sri Lanka, Nigeria, The Philippines, Cameroon and Zambia.

Expert review

Deep rating:Stable+

Rated by ICObench:4,5 in 5

Overall score:9 in 10